Open Enrollment

Oct 14 - Nov 7

This is your annual opportunity to make changes, enroll, or add/remove dependents to your State of Maryland health benefits.

October 14 - November 7

Open Enrollment for the State Employee and Retiree Health Benefits will take place from October 14 through 5:00 PM EST on November 7, 2025 for the new plan year that begins on January 1, 2026. This is your annual opportunity to make changes, enroll, or add/remove dependents to your State of Maryland health benefits.

Important Dates

November 7, 2025, at 5:00 PM EST: The deadline to submit all enrollment changes and required documentation. Changes will take effect on January 1, 2026.

All faculty, staff, and benefits-eligible graduate assistants should review their options during the open enrollment period.

Step by Step Instructions

A quick reference guide (PDF) for completing your open enrollment.

2026 Health Benefits

Read about what's new for 2026 and more information on your health benefits.

Your Employee Health Benefits: What's New for 2026

October 9, 2025 11:00 am - 12:00 pm

Join us for an informative Zoom session where we’ll explore what's new for your health benefits for 2026 and answer important questions, including:

- What is new for 2026?

- How do I add dependents?

- Where is my W#?

- Questions submitted during registration.

Don’t miss this opportunity to learn what's new for 2026.

Register

Virtual Information Sessions

The State of Maryland has a series of Interactive Virtual Open Enrollment Events:

- There are 11 sessions a day

- Sessions are carrier specific as described in the link above (Medical, Dental, Prescription carriers, etc.)

- Employees can Join as many as you like – no need to register in advance

- Sessions are interactive Q & A opportunities.

Who needs to take action?

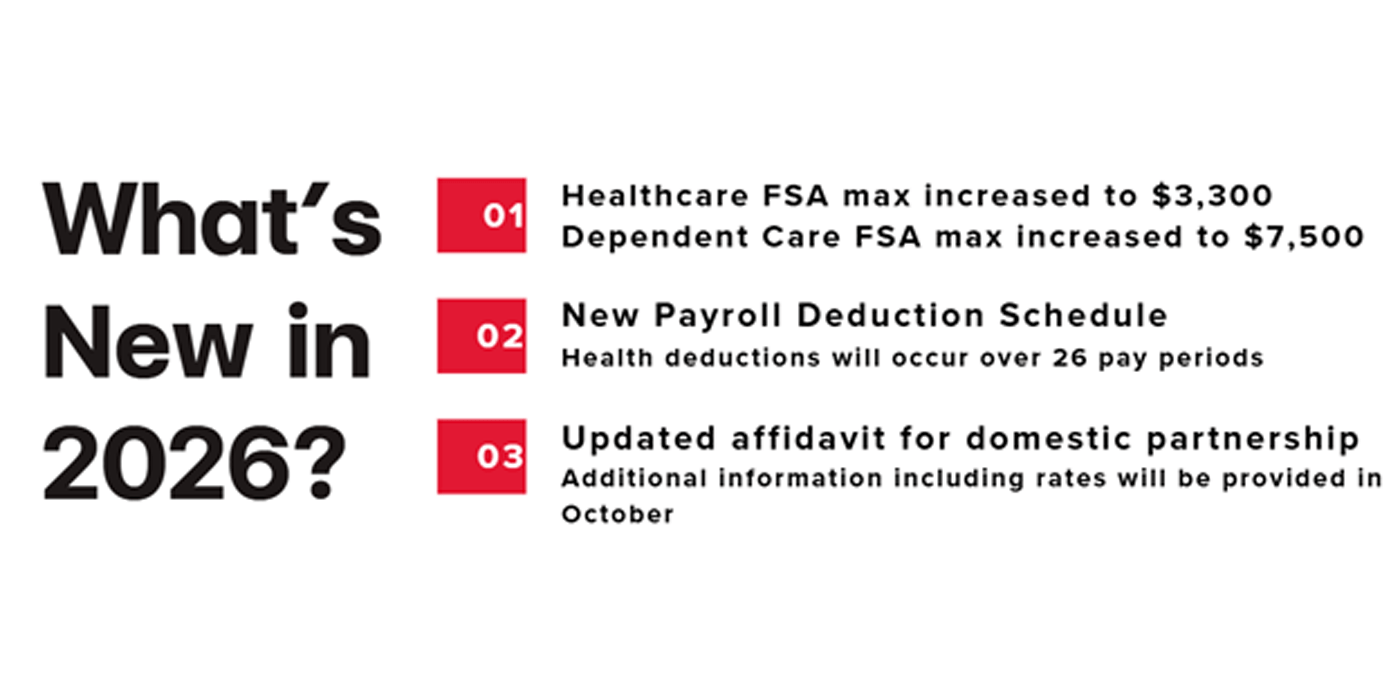

If you want a Flexible Spending Account (FSA) in 2026

If you want a Flexible Spending Account (FSA) for healthcare and/or dependent care in 2026, you must re-enroll. This is not an automatic process, and your FSA from 2025 will not carry over.

- The maximum contribution for a Health Care FSA in 2026 is $3,300.

- The maximum contribution for a Dependent Care FSA in 2026 is $7,500.

If you want to change your State of Maryland Health Benefits

You need to take action if you want to make any changes to your current State of Maryland health benefits, including:

- Medical

- Dental

- Accidental death & dismemberment

- Life insurance

- Pharmacy plans

If you are adding dependents

If you are adding a spouse or child to your coverage, you must provide the required documentation (like a birth or marriage certificate). This documentation must be submitted with your enrollment through the SPS Benefit Event by 5:00 PM EST on November 7, 2025. If you miss this deadline, your dependent will not be covered.

Who does not need to take action?

You do not need to do anything if you are keeping your current health benefits and are not adding or removing any dependents. Your current coverage will automatically continue into the new year.

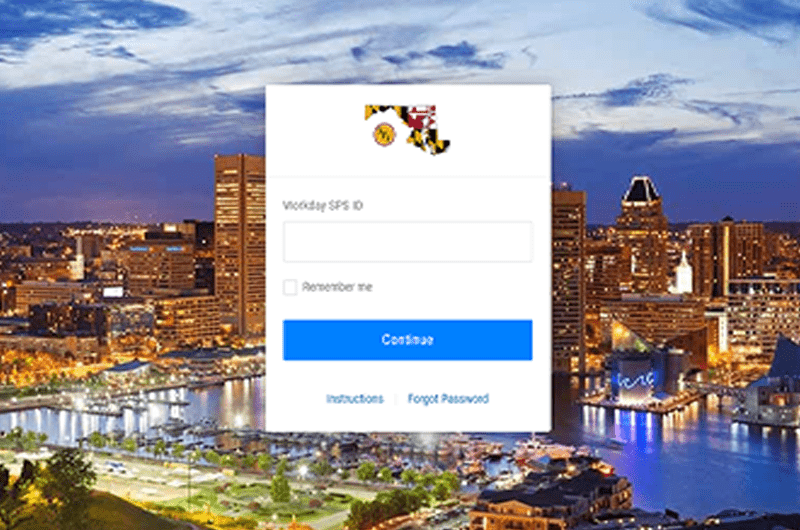

Online Benefit System (SPS)

- Add/Remove a Dependent

- Change Benefit Plans

- Enroll/Re-Enroll in a Flexible Spending Account (FSA)

Faculty, staff and benefits-eligible graduate assistants can make benefit changes in SPS. Instructions can be found here.

Retirees will receive enrollment packages in the mail directly from the Benefits Division of the State of Maryland late September, early October. Retirees should follow the enrollment instructions provided in that mailed package. Retirees may direct questions about their benefits and Open Enrollment to the State of Maryland Employee Benefits Division at 410.767.4775.

SPS will show your 2025 benefit elections if you participate in the State’s Employee Benefits Program.

Changes and new rates go into effect on January 1, 2026

No Action Required to Keep Current Benefits, Except FSAs

FSA plans must be renewed annually, enrollments are not carried over year-to-year in accordance with IRS regulations. If you participated in an FSA in 2025 and need an FSA in 2026, you will need to re-enroll.

You can reset or change your password the following ways:

1. If you forgot your password:

- Use the Forgot Password link on the SPS sign-in page

- If you are unable to reset using your security questions, click on the following SPS Workday Password Reset Request Form. Requests may take 2 business days.

2. If you know your password but want to change it:

- Change your password in SPS under your profile found in the upper right hand corner of the page.

Password Change Reference Guide

Adding a second MultiFactor Authentication Factor to OneLogin

PASSWORD RULES

- Your new password must not be the same as your current password or user name.

- Minimum number of characters: 8

- Must have at least one of the following character types:

- Uppercase letters (A,B,C…)

- Lowercase letters (a,b,c…)

- Numerals (0 – 9)

- Special characters as follows: !”#$%&'()*+,-./:;=>?@[[\]^_`{|}

During a qualifying life event or Open Enrollment, you have the ability to add dependents to medical, dental, prescription, life insurance and/or AD&D coverage. All additions of new dependents require mandatory documentation for each dependent added.

Important Tips:

- You MUST submit the REQUIRED DOCUMENTATION for all newly added or re-enrolled dependents before 5:00PM EST on November 7, 2025.

- If you do not attach the required documentation the dependent will be removed from coverage and will be ineligible to enroll until the next qualifying life event or Open Enrollment.

- Refer to the REQUIRED DOCUMENTATION list for each dependent relationship. You do not need to attach supporting documentation for any dependent currently enrolled in coverage.

- Note: Marriage Certificates must be the “certified” version signed by the court clerk's office. In many states, it may take time to order this version. Please plan ahead if you do not have this version of your marriage certificate for newly added spouses. The certified marriage certificate must be uploaded for a newly added spouse before 5:00 PM EST on November 7, 2025.

Translation of Non-English Documentation: If you submit dependent documentation that is written in a language other than English, it must be translated by an official translator – someone other than you or your dependent(s). Generally, an official translator can be found at any college or university. The translation of each document must be signed by the translator and notarized.

Log in with your SPS ID that starts with a “W”. Your SPS ID and can be viewed in Workday under:

Worker Profile > Personal > IDs > Other IDs

Please use the following password formation to make up your initial password:

- Use capital first letter of your first name

- Use lower case first letter of last name

- Use your 4 digit birth year

- Use last 4 digits of your social security number

- Use the symbol $

An example password for Jon Smith is: Js19804321$ For a password reset, please complete the following SPS Workday Password Reset Request form. Requests may take 2 business days, therefore, plan accordingly. Please visit the following SPS Webpage for additional help.