Non-Standard Pay

Non-Standard Pay

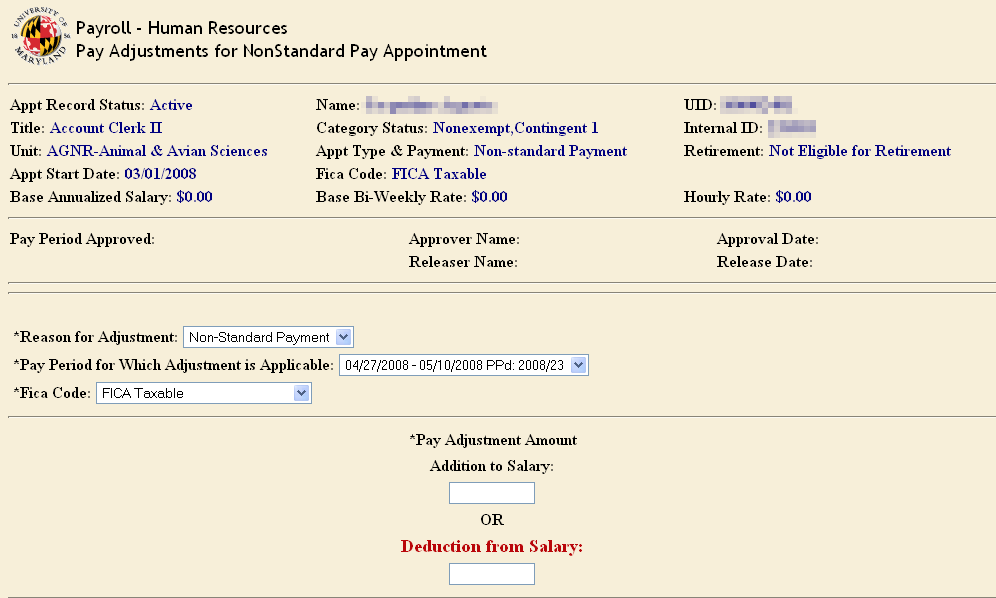

A Non-standard Pay Adjustment is used when making a payment for a Non-standard pay appointment that has been created & approved in the “Employee & Appointment” system. Non-standard pay appointments are used to pay employee’s for short term or sporadic reasons such as commencement performers or those employees that do not receive regular bi-weekly payments. Upon choosing “Non Standard Pay” the PHR creator is taken directly to the Non Standard Pay Adjustment screen. You do not have to choose a “type” or “reason” for the adjustment.

A Non-standard Pay Adjustment is used when making a payment for a Non-standard pay appointment that has been created & approved in the “Employee & Appointment” system. Non-standard pay appointments are used to pay employee’s for short term or sporadic reasons such as commencement performers or those employees that do not receive regular bi-weekly payments. Upon choosing “Non Standard Pay” the PHR creator is taken directly to the Non Standard Pay Adjustment screen. You do not have to choose a “type” or “reason” for the adjustment.

- Select “Pay Period where Adjustment is Applicable” (this is the pay period that the employee performed the work)

- You may also change the “FICA Code” for the adjustment if necessary. Most pay adjustments are left at the system default with the exception of “Accident Leave” which may require a different FICA taxability. In this case “FICA Taxable” is defaulted since a Final Leave Payout is FICA taxable. Questions concerning FICA taxability should be directed to Payroll Services.

- Enter “Pay Adjustment Amount” – this is the amount the employee should receive as the non-standard amount for services

- Enter “Notes” (if applicable)

- Click “Save”. Now, you can see the link at the bottom of the page to change the account number if necessary.

- Click “Release for Approval”

- Now, an e-mail message is sent to the department approvers alerting them to approve the pay adjustment.

- You can see a RED message saying “Adjustment has been released, No Updates Allowed” and you are finished with the pay adjustment.

- Click “Return to Main Menu”

Important Information: All Non-Standard Pay Appointments require a “Pay Adjustment” for each pay period that the employee is due compensation. Otherwise the employee will not be paid.