Pay Adjustments Overview

Pay adjustments are created when the PHR appointment, or the employee’s time record, cannot accomplish the action that will ensure the employee is paid correctly for the pay period. For example, if the appointment is created late or an employee is reclassified retroactively a pay adjustment must be created to pay the employee for the back pay owed. Also, if an employee separates from employment a pay adjustment must be created if the employee was leave eligible and should therefore receive a final leave payout. In addition, pay adjustments must be created each time an employee is to be paid using a “non-standard payment”.

All Pay adjustments must be created, released, and approved within the issuing unit. These transactions should be created & approved by midnight of the second Tuesday (Day 10) of the pay period. Adjustments approved after this day, or the transaction deadline for that pay period, will be applied to the next pay period’s processing.

14 Day Bi-Weekly Factor vs. 10 Day Bi-Weekly Factor

Pay Adjustments for current and active salaried appointments that require a corresponding Pay Adjustment should be calculated using a 14 day bi-weekly pay factor. For all initial, new, or terminating appointments the Pay Adjustment should be calculated using a 10 day bi-weekly factor.

Pay Adjustments are routinely audited by the Department of Payroll Services. Pay Adjustments that are part of the audit process are not “active” in PHR until the adjustment is “approved” by Payroll Services. It is therefore essential that proper documentation for the pay adjustment be included in each pay adjustment’s “Notes” section. Each pay adjustment note must state a clear reason for the adjustment, the dates that are effected by the adjustment, and ALL manual calculations used for the pay adjustment amount. Also, all PHR appointments are available for 2 pay periods after their termination date so the PHR creator can create final leave payments or back pay adjustments during this period. Any adjustments required after this two pay period time period can only be accomplished by contacting Payroll Services.

PHR Pay Adjustments

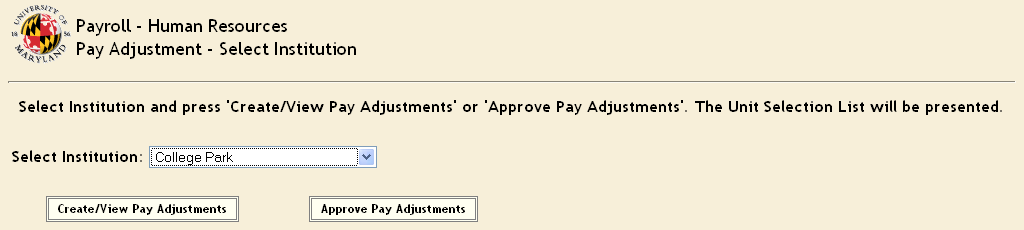

To access the PHR Pay Adjustment module:

- Click “Pay Adjustments”

- Sign in using your university UID and password

- Select the appropriate security access level (if applicable)

- Click “Create Pay Adjustments”

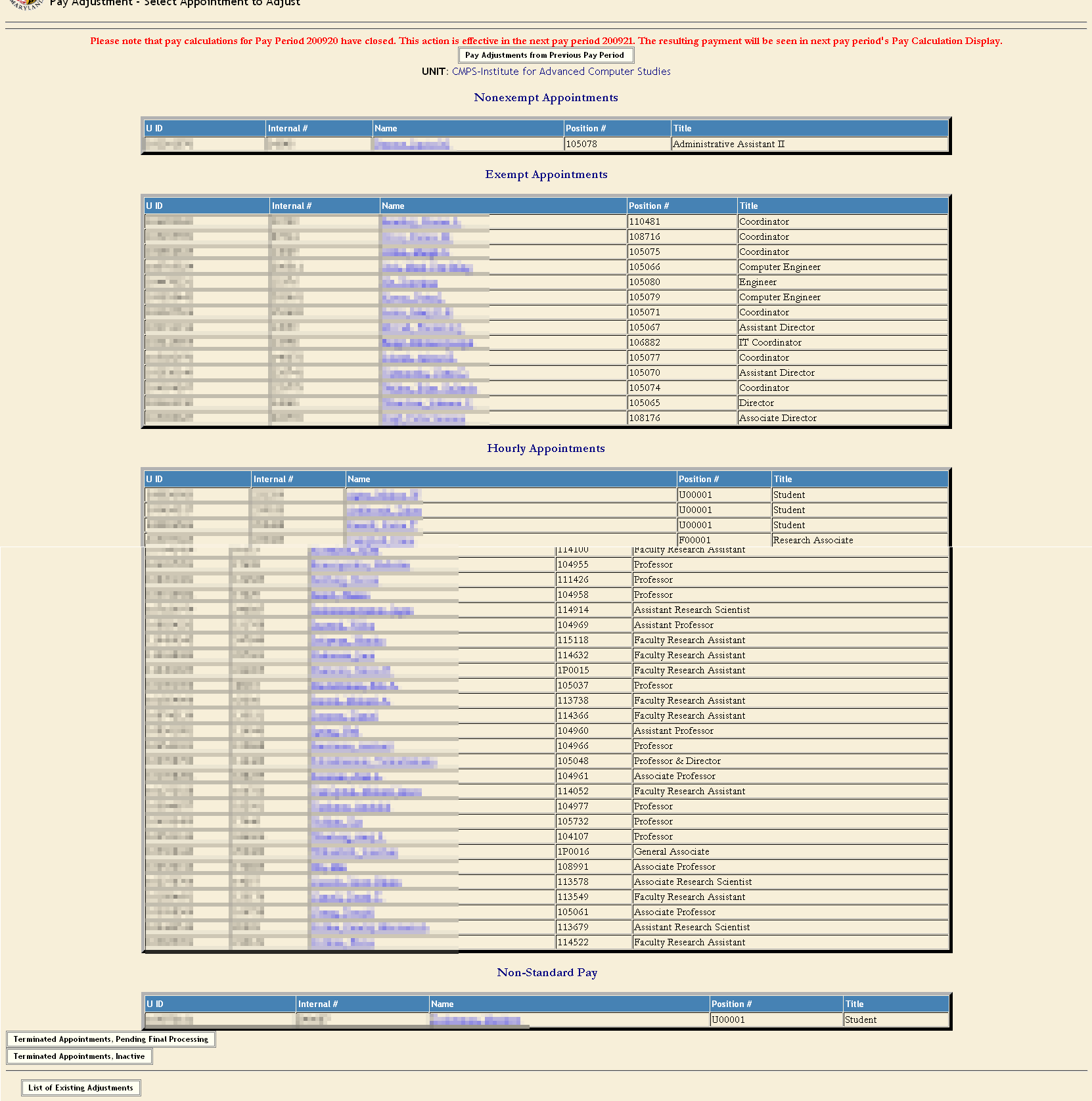

Pay Adjustments – Select Appointment to Adjust

This is the “Select Appointment to Adjust” page containing all active employees within the unit.

This is the “Select Appointment to Adjust” page containing all active employees within the unit.- Scroll to the bottom and see a button labeled “Terminated Pending Final Processing”– These are appointments that have terminated less than 2 pay periods ago.

- Also notice a button for “Terminated Appointments” which are those appointments that have been terminated for longer than two pay periods. These appointments will require a reinstatement by the Department of Payroll Services in order to create transactions.

- There is also a button labeled “List of Existing Appointments” that will show the user all of the existing pay adjustments that have been created in this department and are being processed for the current pay period.

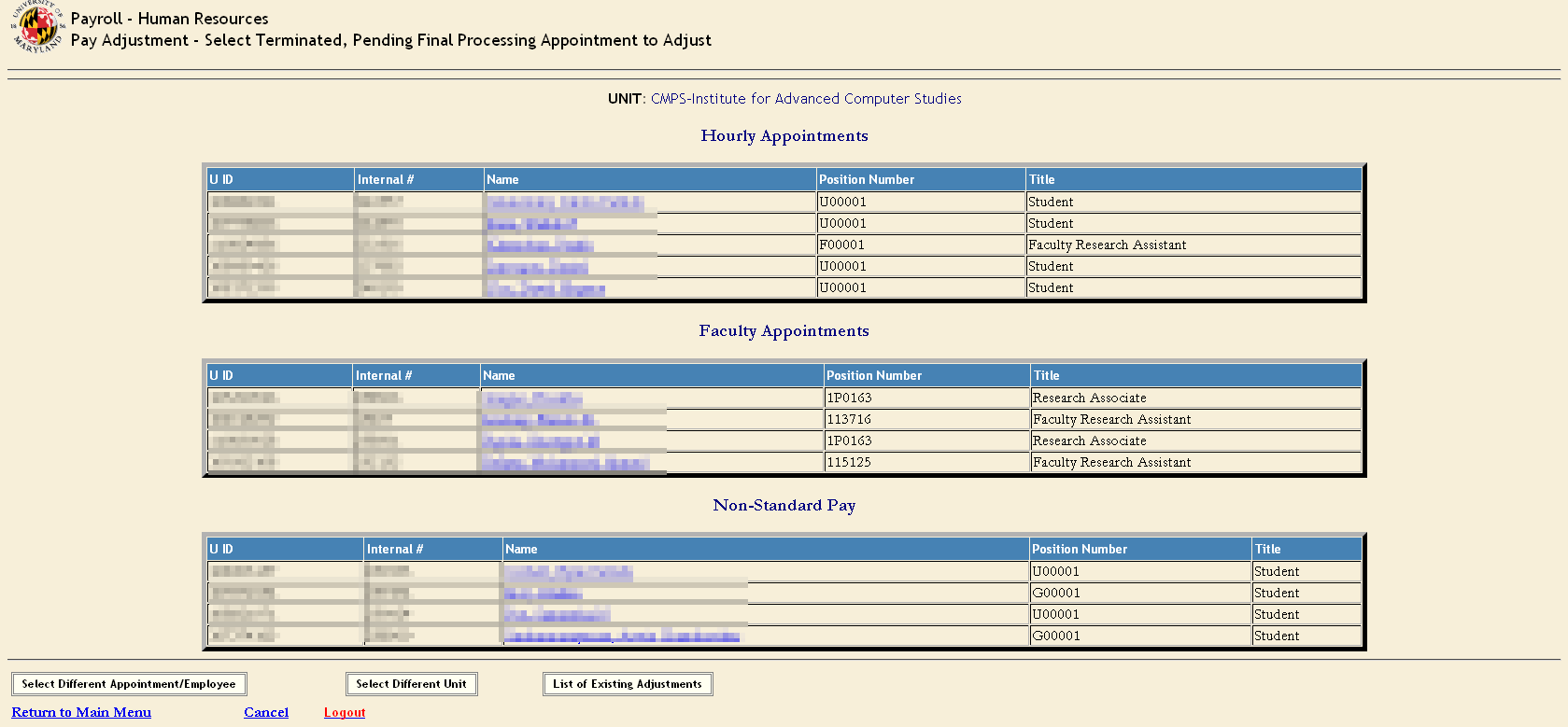

Select Terminated Appointment to Adjust

To create a final leave payout the employee must have a terminated appointment in PHR “Employee & Appointment” module. The “Appointment Record Status” must read “Terminated Pending Final Processing”. Once the termination date is created & approved in the “Employee & Appointment” module:

- From the “Terminated Appointments, Pending Final Processing Selection List” chose the employee.